-

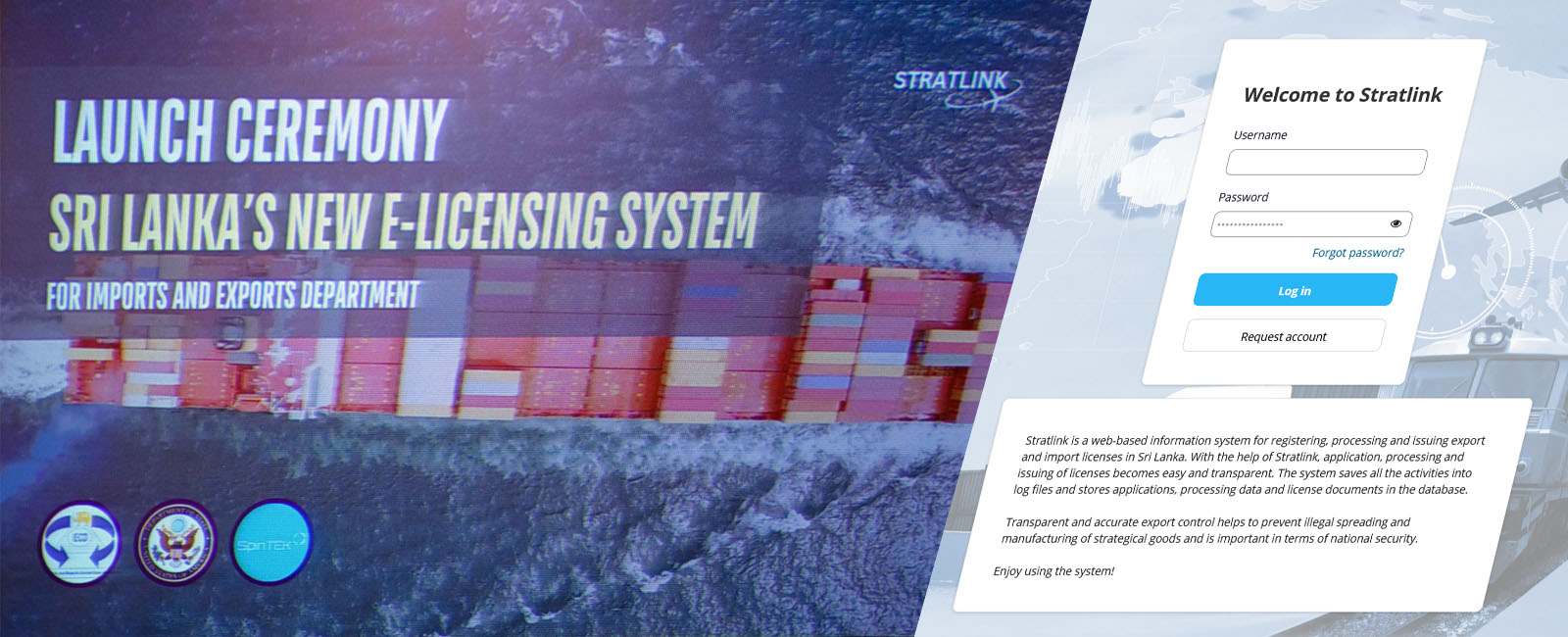

Launch Ceremony Sri Lanka's New e-Licensing System

Launch Ceremony Sri Lanka's New e-Licensing System -

Launch Ceremony Sri Lanka's New e-Licensing System

Launch Ceremony Sri Lanka's New e-Licensing System -

Launch Ceremony Sri Lanka's New e-Licensing System

Launch Ceremony Sri Lanka's New e-Licensing System -

Launch Ceremony Sri Lanka's New e-Licensing SystemLaunch Ceremony Sri Lanka's New e-Licensing SystemLaunch Ceremony Sri Lanka's New e-Licensing System

Launch Ceremony Sri Lanka's New e-Licensing SystemLaunch Ceremony Sri Lanka's New e-Licensing SystemLaunch Ceremony Sri Lanka's New e-Licensing System -

Launch Ceremony Sri Lanka's New e-Licensing System

Launch Ceremony Sri Lanka's New e-Licensing System -

-

-

-

-

-

-

-

Recommendation Authorities

National Medicine Regulatory Authority

National Medicine Regulatory Authority Department of Animal Production & Health

Department of Animal Production & Health Ayurvedic

Ayurvedic

Department Homeopathy

Homeopathy

Council Ministry of Social Empowerment & Welfare

Ministry of Social Empowerment & Welfare Civil Aviation

Civil Aviation

Authority Ministry of Industry & Commerce

Ministry of Industry & Commerce Ministry of

Ministry of

Defence Sri Lanka State Trading (General) Corporation

Sri Lanka State Trading (General) Corporation Precursor Control

Precursor Control

Authority Department of Fisheries & Aquatic Authority

Department of Fisheries & Aquatic Authority Ministry of Petroleum & Petroleum Resources Development

Ministry of Petroleum & Petroleum Resources Development Registrar of

Registrar of

Pesticides National Fertilizer

National Fertilizer

Secretariat Agriculture

Agriculture

Department Sri Lanka

Sri Lanka

Standards Institute Sri Lanka

Sri Lanka

Excise Department Telecommunication Regulatory Commission

Telecommunication Regulatory Commission National

National

Ozone Unit Central Environment Authority

Central Environment Authority Sri Lanka Atomic Energy Regulatory Council

Sri Lanka Atomic Energy Regulatory Council Sri Lanka

Sri Lanka

Tea Board Forest

Forest

Department Sri Lanka

Sri Lanka

Central Bank Marine Environment Protection Authority

Marine Environment Protection Authority Sri Lanka

Sri Lanka

Customs Sri Lanka

Sri Lanka

Port Authority

Imports

Imports

100 - Importation of Vehicles under the Foreign Exchange earned (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization - Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual - National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

- Photographs showing front and back side of the vehicle

- Bank Statements to prove remittance of foreign exchange over USD 50,000 to Sri Lanka during the last 3 years

- In the case of 3-5 years' old vehicle, it should have been registered under applicant’s name for over 01 year

- In the case of 5-7 years' old vehicle, it should have been registered under applicant's name for over 03 years

- Copies of Passport and Visa (Visa should be Dual citizenship Visa, Residence Visa or Work Visa)

Procedure

- Submit the above documents required to obtain the license to the Counter of the relevant Unit

- Make payments to the Shroff using the Paying-in-Voucher issued by the Counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the Counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- In the case of 3-5 years old vehicle, 4% CIF Value + Value Added Tax

- In the case of 5-7 years old vehicle, 7% CIF Value + Value Added Tax

Harmonized System Codes

| Column 1 HS Heading | Column 11 HS Code |

Column 111 Description |

Subjected to License Control |

| 87.03 | Motor cars and other motor vehicles principally designed for the transport of persons (other than those of Heading 87.02), including station wagons and racing cars | ||

|

8703.10 |

Vehicles specially designed for travelling on snow; golf cars and similar vehicles | ||

| 8703.10.20 | More than three years old |

L |

|

| Other vehicles, with spark-ignition internal combustion reciprocating piston engine | |||

| 8703.21 | Of cylinder capacity not exceeding 1,000 cc | ||

| 8703.21.20 | Ambulances and prison vans more than two years old | L | |

| 8703.21.40 | Hearses more than three years old | L | |

| Auto-trishaws | |||

| 8703.21.51 | With two-stroke petrol engine | L | |

| 8703.21.53 | Other driven by liquefied petroleum (LP) gas, more than two years old | L | |

| 8703.21.55 | Other, more than two years old | L | |

| Motor cars including station wagons and racing cars, more than three years old | |||

| 8703.21.71 | Hybrid Electric Vehicles | L | |

| 8703.21.79 |

Other |

L | |

|

Other |

|||

| 8703.21.93 |

More than three years old |

L | |

| 8703.22 | Of a cylinder capacity exceeding 1,000 cc but not exceeding 1,500 cc | ||

| 8703.22.20 | Ambulances and prison vans more than three years old | L | |

| 8703.22.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, not more than three years old | |||

| 8703.22.61 | Hybrid electric vehicles | L | |

| 8703.22.69 | Other | L | |

| Other, not more than three years old | |||

| 8703.22.81 | Hybrid electric vehicles | L | |

| 8703.22.89 | Other | L | |

| 8703.23 | Of a cylinder capacity exceeding 1,500 cc but not exceeding 3,000 cc | ||

| 8703.23.20 | Ambulances and prison vans more than three years old | L | |

| 8703.23.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity not exceeding 2,000 cc, not more than three years old | |||

| 8703.23.61 | Hybrid electric vehicles of a cylinder capacity not exceeding 1600 cc | L | |

| 8703.23.62 | Other, of a cylinder capacity not exceeding 1,600 cc | L | |

| 8703.23.69 | Other | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity exceeding 2,000 cc, more than three years old : | |||

| 8703.23.81 | Hybrid electric vehicles | L | |

| 8703.23.89 | Other | L | |

| Other | |||

| 8703.23.93 | Hybrid electric vehicles of a cylinder capacity not exceeding 2,000 cc, more than three years old | L | |

| 8703.23.94 | Other, of a cylinder capacity not exceeding 2,000 cc, more than three years old | L | |

| 8703.23.97 | Hybrid electric vehicles of a cylinder capacity exceeding 2,000 cc, more than three years old | L | |

| 8703.23.98 | Other, of a cylinder capacity exceeding 2,000 cc, more than three years old | L | |

| 8703.24 | Of a cylinder capacity exceeding 3,000 cc | ||

| 8703.24.20 | Ambulances and prison vans more than three years old | L | |

| 8703.24.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.24.61 | Hybrid electric vehicles

|

L | |

| 8703.24.69 | Other | L | |

| Other, not more than three years old | |||

| 8703.24.81 | Hybrid electric vehicles | L | |

| 8703.24.89 | Other | L | |

| Other vehicles, with compression-ignition internal combustion piston engine (diesel or semi-diesel) | |||

| 8703.31 | Of a cylinder capacity not exceeding 1,500 cc | ||

| 8703.31.20 | Ambulances and prison vans more than three years old | L | |

| 8703.31.40 | Hearses more than three years old | L | |

| 8703.31.60 | Auto-trishaws more than two years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.31.81 | Hybrid electric vehicles | L | |

| 8703.31.89 | Other | L | |

| Other | |||

| 8703.31.93 | Hybrid electric vehicles more than three years old | L | |

| 8703.31.94 | Other, more than three years old | L | |

| 8703.32 | Of a cylinder capacity exceeding 1,500 cc but not exceeding 2,500 cc | ||

| 8703.32.20 | Ambulances and prison vans more than three years old | L | |

| 8703.32.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity not exceeding 2,000 cc, not more than three years old | |||

| 8703.32.69 | Other | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity exceeding 2,000 cc, more than three years old : | |||

| 8703.32.81 | Hybrid electric vehicles | L | |

| 8703.32.89 | Other | L | |

| 8703.32.96 | Hybrid electric vehicles of a cylinder capacity not exceeding 2,000cc, more than three years old | L | |

| 8703.32.97 | Other, of a cylinder capacity not exceeding 2,000cc., more than three years old | L | |

| 8703.32.98 | Hybrid electric vehicles of a cylinder capacity exceeding 2,000cc., more than three years old | L | |

| 8703.32.99 | Other, of a cylinder capacity exceeding 2,000cc., more than three years old | ||

| 8703.33 | Of a cylinder capacity exceeding 2,500 cc | ||

| 8703.33.20 | Ambulances and prison vans more than three years old | L | |

| 8703.33.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.33.61 | Hybrid electric vehicles | L | |

| 8703.33.69 | Other | L | |

| Other, more than three years old : | |||

| 8703.33.81 | Hybrid electric vehicles | L | |

| 8703.33.89 | Other | L | |

| 8703.90 | Other |

110 - Motor vehicles - Gifts, Family members, Welfare organizations (This scheme is not currently operational.)

This section is temporary suspended

120 - Vehicles imported by Foreign Nationals (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization - Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual - National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

- Photographs showing front and back side of the vehicle

- The applicant should have a valid residential visa in Sri Lanka for a period exceeding 06 months.

- Copies of Passport

- Motor vehicle should not be older than 03 years.

Procedure

- Submit the above documents required to obtain the license to the Counter of the relevant Unit

- Secure approval of the Minister in charge of the subject for the above documents required for obtaining the license

- Make payments to the Shroff using the Paying-in-Voucher issued by the Counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the Counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- 0.3% of CIF + Value Added Tax

Harmonized System Codes

| Column 1 HS Heading | Column 11 HS Code |

Column 111 Description |

Subjected to License Control |

| 87.03 | Motor cars and other motor vehicles principally designed for the transport of persons (other than those of Heading 87.02), including station wagons and racing cars | ||

|

8703.10 |

Vehicles specially designed for travelling on snow; golf cars and similar vehicles | ||

| 8703.10.20 | More than three years old |

L |

|

| Other vehicles, with spark-ignition internal combustion reciprocating piston engine | |||

| 8703.21 | Of cylinder capacity not exceeding 1,000 cc | ||

| 8703.21.20 | Ambulances and prison vans more than two years old | L | |

| 8703.21.40 | Hearses more than three years old | L | |

| Auto-trishaws | |||

| 8703.21.51 | With two-stroke petrol engine | L | |

| 8703.21.53 | Other driven by liquefied petroleum (LP) gas, more than two years old | L | |

| 8703.21.55 | Other, more than two years old | L | |

| Motor cars including station wagons and racing cars, more than three years old | |||

| 8703.21.71 | Hybrid Electric Vehicles | L | |

| 8703.21.79 |

Other |

L | |

|

Other |

|||

| 8703.21.93 |

More than three years old |

L | |

| 8703.22 | Of a cylinder capacity exceeding 1,000 cc but not exceeding 1,500 cc | ||

| 8703.22.20 | Ambulances and prison vans more than three years old | L | |

| 8703.22.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, not more than three years old | |||

| 8703.22.61 | Hybrid electric vehicles | L | |

| 8703.22.69 | Other | L | |

| Other, not more than three years old | |||

| 8703.22.81 | Hybrid electric vehicles | L | |

| 8703.22.89 | Other | L | |

| 8703.23 | Of a cylinder capacity exceeding 1,500 cc but not exceeding 3,000 cc | ||

| 8703.23.20 | Ambulances and prison vans more than three years old | L | |

| 8703.23.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity not exceeding 2,000 cc, not more than three years old | |||

| 8703.23.61 | Hybrid electric vehicles of a cylinder capacity not exceeding 1600 cc | L | |

| 8703.23.62 | Other, of a cylinder capacity not exceeding 1,600 cc | L | |

| 8703.23.69 | Other | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity exceeding 2,000 cc, more than three years old : | |||

| 8703.23.81 | Hybrid electric vehicles | L | |

| 8703.23.89 | Other | L | |

| Other | |||

| 8703.23.93 | Hybrid electric vehicles of a cylinder capacity not exceeding 2,000 cc, more than three years old | L | |

| 8703.23.94 | Other, of a cylinder capacity not exceeding 2,000 cc, more than three years old | L | |

| 8703.23.97 | Hybrid electric vehicles of a cylinder capacity exceeding 2,000 cc, more than three years old | L | |

| 8703.23.98 | Other, of a cylinder capacity exceeding 2,000 cc, more than three years old | L | |

| 8703.24 | Of a cylinder capacity exceeding 3,000 cc | ||

| 8703.24.20 | Ambulances and prison vans more than three years old | L | |

| 8703.24.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.24.61 | Hybrid electric vehicles

|

L | |

| 8703.24.69 | Other | L | |

| Other, not more than three years old | |||

| 8703.24.81 | Hybrid electric vehicles | L | |

| 8703.24.89 | Other | L | |

| Other vehicles, with compression-ignition internal combustion piston engine (diesel or semi-diesel) | |||

| 8703.31 | Of a cylinder capacity not exceeding 1,500 cc | ||

| 8703.31.20 | Ambulances and prison vans more than three years old | L | |

| 8703.31.40 | Hearses more than three years old | L | |

| 8703.31.60 | Auto-trishaws more than two years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.31.81 | Hybrid electric vehicles | L | |

| 8703.31.89 | Other | L | |

| Other | |||

| 8703.31.93 | Hybrid electric vehicles more than three years old | L | |

| 8703.31.94 | Other, more than three years old | L | |

| 8703.32 | Of a cylinder capacity exceeding 1,500 cc but not exceeding 2,500 cc | ||

| 8703.32.20 | Ambulances and prison vans more than three years old | L | |

| 8703.32.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity not exceeding 2,000 cc, not more than three years old | |||

| 8703.32.69 | Other | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity exceeding 2,000 cc, more than three years old : | |||

| 8703.32.81 | Hybrid electric vehicles | L | |

| 8703.32.89 | Other | L | |

| 8703.32.96 | Hybrid electric vehicles of a cylinder capacity not exceeding 2,000cc, more than three years old | L | |

| 8703.32.97 | Other, of a cylinder capacity not exceeding 2,000cc., more than three years old | L | |

| 8703.32.98 | Hybrid electric vehicles of a cylinder capacity exceeding 2,000cc., more than three years old | L | |

| 8703.32.99 | Other, of a cylinder capacity exceeding 2,000cc., more than three years old | ||

| 8703.33 | Of a cylinder capacity exceeding 2,500 cc | ||

| 8703.33.20 | Ambulances and prison vans more than three years old | L | |

| 8703.33.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.33.61 | Hybrid electric vehicles | L | |

| 8703.33.69 | Other | L | |

| Other, more than three years old : | |||

| 8703.33.81 | Hybrid electric vehicles | L | |

| 8703.33.89 | Other | L | |

| 8703.90 | Other |

130 - Vehicles imported by Diplomatic Officers

This section is temporary suspended.

140 - Vehicles imported for Disabled Persons (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization, Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual, National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

- Photographs showing front and back side of the vehicle

- Affidavit confirming disability

- Letter given by the Divisional Secretariat confirming the disability

- Where the supplier is an individual (not a business organization), copy of his passport

- Letter issued by the National Secretariat for Persons with Disabilities of the Ministry of Social Empowerment and Welfare confirming the disability

Procedure

- Submit the above documents required to obtain the license to the Counter of the relevant Unit

- Make payments to the Shroff using the Paying-in-Voucher issued by the Counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the Counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- 10 % of CIF Value + Value Added Tax

Harmonized System Codes

| Column 1 HS Heading | Column 11 HS Code |

Column 111 Description |

Subjected to License Control |

| 87.03 | Motor cars and other motor vehicles principally designed for the transport of persons (other than those of Heading 87.02), including station wagons and racing cars | ||

|

8703.10 |

Vehicles specially designed for travelling on snow; golf cars and similar vehicles | ||

| 8703.10.20 | More than three years old |

L |

|

| Other vehicles, with spark-ignition internal combustion reciprocating piston engine | |||

| 8703.21 | Of cylinder capacity not exceeding 1,000 cc | ||

| 8703.21.20 | Ambulances and prison vans more than two years old | L | |

| 8703.21.40 | Hearses more than three years old | L | |

| Auto-trishaws | |||

| 8703.21.51 | With two-stroke petrol engine | L | |

| 8703.21.53 | Other driven by liquefied petroleum (LP) gas, more than two years old | L | |

| 8703.21.55 | Other, more than two years old | L | |

| Motor cars including station wagons and racing cars, more than three years old | |||

| 8703.21.71 | Hybrid Electric Vehicles | L | |

| 8703.21.79 |

Other |

L | |

|

Other |

|||

| 8703.21.93 |

More than three years old |

L | |

| 8703.22 | Of a cylinder capacity exceeding 1,000 cc but not exceeding 1,500 cc | ||

| 8703.22.20 | Ambulances and prison vans more than three years old | L | |

| 8703.22.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, not more than three years old | |||

| 8703.22.61 | Hybrid electric vehicles | L | |

| 8703.22.69 | Other | L | |

| Other, not more than three years old | |||

| 8703.22.81 | Hybrid electric vehicles | L | |

| 8703.22.89 | Other | L | |

| 8703.23 | Of a cylinder capacity exceeding 1,500 cc but not exceeding 3,000 cc | ||

| 8703.23.20 | Ambulances and prison vans more than three years old | L | |

| 8703.23.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity not exceeding 2,000 cc, not more than three years old | |||

| 8703.23.61 | Hybrid electric vehicles of a cylinder capacity not exceeding 1600 cc | L | |

| 8703.23.62 | Other, of a cylinder capacity not exceeding 1,600 cc | L | |

| 8703.23.69 | Other | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity exceeding 2,000 cc, more than three years old : | |||

| 8703.23.81 | Hybrid electric vehicles | L | |

| 8703.23.89 | Other | L | |

| Other | |||

| 8703.23.93 | Hybrid electric vehicles of a cylinder capacity not exceeding 2,000 cc, more than three years old | L | |

| 8703.23.94 | Other, of a cylinder capacity not exceeding 2,000 cc, more than three years old | L | |

| 8703.23.97 | Hybrid electric vehicles of a cylinder capacity exceeding 2,000 cc, more than three years old | L | |

| 8703.23.98 | Other, of a cylinder capacity exceeding 2,000 cc, more than three years old | L | |

| 8703.24 | Of a cylinder capacity exceeding 3,000 cc | ||

| 8703.24.20 | Ambulances and prison vans more than three years old | L | |

| 8703.24.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.24.61 | Hybrid electric vehicles

|

L | |

| 8703.24.69 | Other | L | |

| Other, not more than three years old | |||

| 8703.24.81 | Hybrid electric vehicles | L | |

| 8703.24.89 | Other | L | |

| Other vehicles, with compression-ignition internal combustion piston engine (diesel or semi-diesel) | |||

| 8703.31 | Of a cylinder capacity not exceeding 1,500 cc | ||

| 8703.31.20 | Ambulances and prison vans more than three years old | L | |

| 8703.31.40 | Hearses more than three years old | L | |

| 8703.31.60 | Auto-trishaws more than two years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.31.81 | Hybrid electric vehicles | L | |

| 8703.31.89 | Other | L | |

| Other | |||

| 8703.31.93 | Hybrid electric vehicles more than three years old | L | |

| 8703.31.94 | Other, more than three years old | L | |

| 8703.32 | Of a cylinder capacity exceeding 1,500 cc but not exceeding 2,500 cc | ||

| 8703.32.20 | Ambulances and prison vans more than three years old | L | |

| 8703.32.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity not exceeding 2,000 cc, not more than three years old | |||

| 8703.32.69 | Other | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity exceeding 2,000 cc, more than three years old : | |||

| 8703.32.81 | Hybrid electric vehicles | L | |

| 8703.32.89 | Other | L | |

| 8703.32.96 | Hybrid electric vehicles of a cylinder capacity not exceeding 2,000cc, more than three years old | L | |

| 8703.32.97 | Other, of a cylinder capacity not exceeding 2,000cc., more than three years old | L | |

| 8703.32.98 | Hybrid electric vehicles of a cylinder capacity exceeding 2,000cc., more than three years old | L | |

| 8703.32.99 | Other, of a cylinder capacity exceeding 2,000cc., more than three years old | ||

| 8703.33 | Of a cylinder capacity exceeding 2,500 cc | ||

| 8703.33.20 | Ambulances and prison vans more than three years old | L | |

| 8703.33.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.33.61 | Hybrid electric vehicles | L | |

| 8703.33.69 | Other | L | |

| Other, more than three years old : | |||

| 8703.33.81 | Hybrid electric vehicles | L | |

| 8703.33.89 | Other | L | |

| 8703.90 | Other |

150 - Vehicles imported as Donations to the Government and Non-Governmental Organizations (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization - Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual - National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

- Photographs showing front and back side of the vehicle

- Letter from the Donor Agency

- Recommendation of the Line Ministry under which the recipient organization comes

Procedure

- Submit the above documents required to obtain the license to the Counter of the relevant Unit

- Make payments to the Shroff using the Paying-in-Voucher issued by the Counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the Counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- Government Organizations - Rs. 50, 000 per unit+ Value Added Tax

- Non-Governmental Organizations – Rs. 25, 000 per unit + Value Added Tax

Customs Classification Codes

| Column 1 HS Heading | Column 11 HS Code |

Column 111 Description |

Subjected to License Control |

| 87.03 | Motor cars and other motor vehicles principally designed for the transport of persons (other than those of Heading 87.02), including station wagons and racing cars | ||

|

8703.10 |

Vehicles specially designed for travelling on snow; golf cars and similar vehicles | ||

| 8703.10.20 | More than three years old |

L |

|

| Other vehicles, with spark-ignition internal combustion reciprocating piston engine | |||

| 8703.21 | Of cylinder capacity not exceeding 1,000 cc | ||

| 8703.21.20 | Ambulances and prison vans more than two years old | L | |

| 8703.21.40 | Hearses more than three years old | L | |

| Auto-trishaws | |||

| 8703.21.51 | With two-stroke petrol engine | L | |

| 8703.21.53 | Other driven by liquefied petroleum (LP) gas, more than two years old | L | |

| 8703.21.55 | Other, more than two years old | L | |

| Motor cars including station wagons and racing cars, more than three years old | |||

| 8703.21.71 | Hybrid Electric Vehicles | L | |

| 8703.21.79 |

Other |

L | |

|

Other |

|||

| 8703.21.93 |

More than three years old |

L | |

| 8703.22 | Of a cylinder capacity exceeding 1,000 cc but not exceeding 1,500 cc | ||

| 8703.22.20 | Ambulances and prison vans more than three years old | L | |

| 8703.22.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, not more than three years old | |||

| 8703.22.61 | Hybrid electric vehicles | L | |

| 8703.22.69 | Other | L | |

| Other, not more than three years old | |||

| 8703.22.81 | Hybrid electric vehicles | L | |

| 8703.22.89 | Other | L | |

| 8703.23 | Of a cylinder capacity exceeding 1,500 cc but not exceeding 3,000 cc | ||

| 8703.23.20 | Ambulances and prison vans more than three years old | L | |

| 8703.23.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity not exceeding 2,000 cc, not more than three years old | |||

| 8703.23.61 | Hybrid electric vehicles of a cylinder capacity not exceeding 1600 cc | L | |

| 8703.23.62 | Other, of a cylinder capacity not exceeding 1,600 cc | L | |

| 8703.23.69 | Other | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity exceeding 2,000 cc, more than three years old : | |||

| 8703.23.81 | Hybrid electric vehicles | L | |

| 8703.23.89 | Other | L | |

| Other | |||

| 8703.23.93 | Hybrid electric vehicles of a cylinder capacity not exceeding 2,000 cc, more than three years old | L | |

| 8703.23.94 | Other, of a cylinder capacity not exceeding 2,000 cc, more than three years old | L | |

| 8703.23.97 | Hybrid electric vehicles of a cylinder capacity exceeding 2,000 cc, more than three years old | L | |

| 8703.23.98 | Other, of a cylinder capacity exceeding 2,000 cc, more than three years old | L | |

| 8703.24 | Of a cylinder capacity exceeding 3,000 cc | ||

| 8703.24.20 | Ambulances and prison vans more than three years old | L | |

| 8703.24.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.24.61 | Hybrid electric vehicles

|

L | |

| 8703.24.69 | Other | L | |

| Other, not more than three years old | |||

| 8703.24.81 | Hybrid electric vehicles | L | |

| 8703.24.89 | Other | L | |

| Other vehicles, with compression-ignition internal combustion piston engine (diesel or semi-diesel) | |||

| 8703.31 | Of a cylinder capacity not exceeding 1,500 cc | ||

| 8703.31.20 | Ambulances and prison vans more than three years old | L | |

| 8703.31.40 | Hearses more than three years old | L | |

| 8703.31.60 | Auto-trishaws more than two years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.31.81 | Hybrid electric vehicles | L | |

| 8703.31.89 | Other | L | |

| Other | |||

| 8703.31.93 | Hybrid electric vehicles more than three years old | L | |

| 8703.31.94 | Other, more than three years old | L | |

| 8703.32 | Of a cylinder capacity exceeding 1,500 cc but not exceeding 2,500 cc | ||

| 8703.32.20 | Ambulances and prison vans more than three years old | L | |

| 8703.32.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity not exceeding 2,000 cc, not more than three years old | |||

| 8703.32.69 | Other | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity exceeding 2,000 cc, more than three years old : | |||

| 8703.32.81 | Hybrid electric vehicles | L | |

| 8703.32.89 | Other | L | |

| 8703.32.96 | Hybrid electric vehicles of a cylinder capacity not exceeding 2,000cc, more than three years old | L | |

| 8703.32.97 | Other, of a cylinder capacity not exceeding 2,000cc., more than three years old | L | |

| 8703.32.98 | Hybrid electric vehicles of a cylinder capacity exceeding 2,000cc., more than three years old | L | |

| 8703.32.99 | Other, of a cylinder capacity exceeding 2,000cc., more than three years old | ||

| 8703.33 | Of a cylinder capacity exceeding 2,500 cc | ||

| 8703.33.20 | Ambulances and prison vans more than three years old | L | |

| 8703.33.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.33.61 | Hybrid electric vehicles | L | |

| 8703.33.69 | Other | L | |

| Other, more than three years old : | |||

| 8703.33.81 | Hybrid electric vehicles | L | |

| 8703.33.89 | Other | L | |

| 8703.90 | Other |

160 - Classic Vehicles

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization - Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual - National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

- Applicant should have the membership of the Classic Car Club for no less than a year

- Bank Accounts Statements

Procedure

- Submit the above documents required to obtain the license to the Counter of the relevant Unit

- Make payments to the Shroff using the Paying-in-Voucher issued by the Counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the Counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- 10 % of CIF Value + Value Added Tax

Customs Classification Codes

| Column 1 HS Heading | Column 11 HS Code |

Column 111 Description |

Subjected to License Control |

| 87.03 | Motor cars and other motor vehicles principally designed for the transport of persons (other than those of Heading 87.02), including station wagons and racing cars | ||

|

8703.10 |

Vehicles specially designed for travelling on snow; golf cars and similar vehicles | ||

| 8703.10.20 | More than three years old |

L |

|

| Other vehicles, with spark-ignition internal combustion reciprocating piston engine | |||

| 8703.21 | Of cylinder capacity not exceeding 1,000 cc | ||

| 8703.21.20 | Ambulances and prison vans more than two years old | L | |

| 8703.21.40 | Hearses more than three years old | L | |

| Auto-trishaws | |||

| 8703.21.51 | With two-stroke petrol engine | L | |

| 8703.21.53 | Other driven by liquefied petroleum (LP) gas, more than two years old | L | |

| 8703.21.55 | Other, more than two years old | L | |

| Motor cars including station wagons and racing cars, more than three years old | |||

| 8703.21.71 | Hybrid Electric Vehicles | L | |

| 8703.21.79 |

Other |

L | |

|

Other |

|||

| 8703.21.93 |

More than three years old |

L | |

| 8703.22 | Of a cylinder capacity exceeding 1,000 cc but not exceeding 1,500 cc | ||

| 8703.22.20 | Ambulances and prison vans more than three years old | L | |

| 8703.22.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, not more than three years old | |||

| 8703.22.61 | Hybrid electric vehicles | L | |

| 8703.22.69 | Other | L | |

| Other, not more than three years old | |||

| 8703.22.81 | Hybrid electric vehicles | L | |

| 8703.22.89 | Other | L | |

| 8703.23 | Of a cylinder capacity exceeding 1,500 cc but not exceeding 3,000 cc | ||

| 8703.23.20 | Ambulances and prison vans more than three years old | L | |

| 8703.23.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity not exceeding 2,000 cc, not more than three years old | |||

| 8703.23.61 | Hybrid electric vehicles of a cylinder capacity not exceeding 1600 cc | L | |

| 8703.23.62 | Other, of a cylinder capacity not exceeding 1,600 cc | L | |

| 8703.23.69 | Other | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity exceeding 2,000 cc, more than three years old : | |||

| 8703.23.81 | Hybrid electric vehicles | L | |

| 8703.23.89 | Other | L | |

| Other | |||

| 8703.23.93 | Hybrid electric vehicles of a cylinder capacity not exceeding 2,000 cc, more than three years old | L | |

| 8703.23.94 | Other, of a cylinder capacity not exceeding 2,000 cc, more than three years old | L | |

| 8703.23.97 | Hybrid electric vehicles of a cylinder capacity exceeding 2,000 cc, more than three years old | L | |

| 8703.23.98 | Other, of a cylinder capacity exceeding 2,000 cc, more than three years old | L | |

| 8703.24 | Of a cylinder capacity exceeding 3,000 cc | ||

| 8703.24.20 | Ambulances and prison vans more than three years old | L | |

| 8703.24.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.24.61 | Hybrid electric vehicles

|

L | |

| 8703.24.69 | Other | L | |

| Other, not more than three years old | |||

| 8703.24.81 | Hybrid electric vehicles | L | |

| 8703.24.89 | Other | L | |

| Other vehicles, with compression-ignition internal combustion piston engine (diesel or semi-diesel) | |||

| 8703.31 | Of a cylinder capacity not exceeding 1,500 cc | ||

| 8703.31.20 | Ambulances and prison vans more than three years old | L | |

| 8703.31.40 | Hearses more than three years old | L | |

| 8703.31.60 | Auto-trishaws more than two years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.31.81 | Hybrid electric vehicles | L | |

| 8703.31.89 | Other | L | |

| Other | |||

| 8703.31.93 | Hybrid electric vehicles more than three years old | L | |

| 8703.31.94 | Other, more than three years old | L | |

| 8703.32 | Of a cylinder capacity exceeding 1,500 cc but not exceeding 2,500 cc | ||

| 8703.32.20 | Ambulances and prison vans more than three years old | L | |

| 8703.32.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity not exceeding 2,000 cc, not more than three years old | |||

| 8703.32.69 | Other | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity exceeding 2,000 cc, more than three years old : | |||

| 8703.32.81 | Hybrid electric vehicles | L | |

| 8703.32.89 | Other | L | |

| 8703.32.96 | Hybrid electric vehicles of a cylinder capacity not exceeding 2,000cc, more than three years old | L | |

| 8703.32.97 | Other, of a cylinder capacity not exceeding 2,000cc., more than three years old | L | |

| 8703.32.98 | Hybrid electric vehicles of a cylinder capacity exceeding 2,000cc., more than three years old | L | |

| 8703.32.99 | Other, of a cylinder capacity exceeding 2,000cc., more than three years old | ||

| 8703.33 | Of a cylinder capacity exceeding 2,500 cc | ||

| 8703.33.20 | Ambulances and prison vans more than three years old | L | |

| 8703.33.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.33.61 | Hybrid electric vehicles | L | |

| 8703.33.69 | Other | L | |

| Other, more than three years old : | |||

| 8703.33.81 | Hybrid electric vehicles | L | |

| 8703.33.89 | Other | L | |

| 8703.90 | Other |

170 - Importation of Vehicles for Religious Organizations

This section is temporary suspended

180 - Vehicles classified under Machinery but not for agricultural purposes and use on roads

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization - Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual - National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

- Photographs showing front and back side of the vehicle

- Bank Accounts Statements

- Recommendation of the Line Ministry to confirm the requirement

Procedure

- Submit the above documents required to obtain the license to the Counter of the relevant Unit

- Make payments to the Shroff using the Paying-in-Voucher issued by the Counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the Counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- 7% of CIF Value + Value Added Tax, in the case of a vehicle 7-10 years old

- 9% of CIF Value + Value Added Tax, in the case of a vehicle 10-12 years old

- 11% of CIF Value + Value Added Tax, in the case of a vehicle 12-15 years old

- 13% of CIF Value + Value Added Tax, in the case of a vehicle 15-20 years old

Customs Classification Codes

| Column 1 HS Heading | Column 11 HS Code | Column 111 Description | Subjected to License Control |

| 87.05 | Special purpose motor vehicles, other than those principally designed for the transport of persons or goods (for example, breakdown lorries, crane lorries, fire fighting vehicles, concrete-mixer lorries, road sweeper lorries, spraying lorries, mobile workshops, mobile radiological units) (+). | ||

| 8705.10 | Crane lorries | ||

| 8705.10.20 | More than ten years old | L | |

| 8705.20 | Mobile drilling derricks : | ||

| 8705.20.20 | More than seven years old | L | |

| 8705.30 | Fire fighting vehicles : | ||

| 8705.30.20 | More than seven years old | L | |

| 8705.40 | Concrete-mixer lorries | ||

| 8705.40.20 | Concrete-mixer lorries | ||

| 8705.90 | Other | ||

| Mobile workshops : | |||

| 8705.90.12 | More than seven years old | L | |

| Gully bowsers equipped with suction pumps for extracting sewage water/waste : | |||

| 8705.90.22 | More than seven years old | L | |

| Other | |||

| 8705.90.92 | g. v. w. not exceeding 4 tones, more than seven years old | L |

185 - Motor Vehicle Trailers (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization - Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual - National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

Procedure

- Submit the above documents required to obtain the license to the Counter of the relevant Unit

- Make payments to the Shroff using the Paying-in-Voucher issued by the Counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the Counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- Rs. 25,000 per unit + Value Added Tax

Customs Classification Codes

| Column 1 HS Heading | Column 11 HS Code | Column 111 Description | Subjected to License Control |

| 87.16 | Trailers and semi-trailers; other vehicles, not mechanically propelled; parts thereof. | ||

| parts thereof. | |||

| 8716.10 | Trailers and semi-trailers of the caravan type, for housing or camping : | ||

| 8716.10.20 | More than five years old | L | |

| 8716.20 | Self-loading or self-unloading trailers and semi-trailers for agricultural purposes : | ||

| 8716.20.20 | More than five years old | L | |

| Other trailers and semi-trailers for the transport of goods : | |||

| 8716.31 | Tanker trailers and tanker semi-trailers : | ||

| 8716.31.20 | More than five years old | L | |

| 8716.39 | Other | ||

| 8716.39.20 | More than five years old | L | |

| 8716.40 | Other trailers and semi-trailers : | ||

| 8716.40.20 | More than five years old | L | |

| 8716.80 | Other vehicles : | ||

| 8716.80.30 | Other not more than five years old | L |

190 - Tractors imported for Agricultural Purposes (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization - Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual - National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

- Photographs showing front and back side of the vehicle

Procedure

- Submit the above documents required to obtain the license to the Counter of the relevant Unit

- Make payments to the Shroff using the Paying-in-Voucher issued by the Counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the Counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- Rs. 30,000 per unit + Value Added Tax

Customs Classification Codes

| Column 1 HS Heading | Column 11 HS Code | Column 111 Description | Subjected to License Control |

| 87.01 | Tractors (other than tractors of heading 87.09) (+). | ||

| 8701.10 | Pedestrian controlled tractors : | ||

| 8701.10.10 | More than ten years old | L | |

| 8701.20 | Road tractors for semi-trailers : | ||

| 8701.20.20 | More than five years old | L | |

| 8701.30 | Track-laying tractors : | ||

| 8701.30.20 | More than five years old | L | |

| 8701.90 | Other : | ||

| 8701.90.20 | Agricultural tractors, more than ten years old | L | |

| 8701.90.40 | Other, more than ten years old | L |

200 - Hearses, Vehicles for Welfare Organizations (Ambulances and Garbage Trucks) (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control -Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization - Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual - National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

- Photographs showing front and back side of the vehicle

- Recommendation of the Divisional Secretary obtained through the Grama Niladhari to confirm running of the business

- Bank Accounts Statements

Procedure

- Submit the above documents required to obtain the license to the Counter of the relevant Unit

- Make payments to the Shroff using the Paying-in-Voucher issued by the Counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the Counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- Hearses - Rs. 75,000 per unit + Value Added Tax

- Ambulances and Garbage Trucks – Private Sector – Rs. 50,000 per unit + Value Added Tax

- Ambulances and Garbage Trucks - Government and Semi-government Sector- Rs. 25,000 per unit + Value Added Tax

Customs Classification Codes

| Column 1 HS Heading | Column 11 HS Code |

Column 111 Description |

Subjected to License Control |

| 87.03 | Motor cars and other motor vehicles principally designed for the transport of persons (other than those of Heading 87.02), including station wagons and racing cars | ||

|

8703.10 |

Vehicles specially designed for travelling on snow; golf cars and similar vehicles | ||

| 8703.10.20 | More than three years old |

L |

|

| Other vehicles, with spark-ignition internal combustion reciprocating piston engine | |||

| 8703.21 | Of cylinder capacity not exceeding 1,000 cc | ||

| 8703.21.20 | Ambulances and prison vans more than two years old | L | |

| 8703.21.40 | Hearses more than three years old | L | |

| Auto-trishaws | |||

| 8703.21.51 | With two-stroke petrol engine | L | |

| 8703.21.53 | Other driven by liquefied petroleum (LP) gas, more than two years old | L | |

| 8703.21.55 | Other, more than two years old | L | |

| Motor cars including station wagons and racing cars, more than three years old | |||

| 8703.21.71 | Hybrid Electric Vehicles | L | |

| 8703.21.79 |

Other |

L | |

|

Other |

|||

| 8703.21.93 |

More than three years old |

L | |

| 8703.22 | Of a cylinder capacity exceeding 1,000 cc but not exceeding 1,500 cc | ||

| 8703.22.20 | Ambulances and prison vans more than three years old | L | |

| 8703.22.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, not more than three years old | |||

| 8703.22.61 | Hybrid electric vehicles | L | |

| 8703.22.69 | Other | L | |

| Other, not more than three years old | |||

| 8703.22.81 | Hybrid electric vehicles | L | |

| 8703.22.89 | Other | L | |

| 8703.23 | Of a cylinder capacity exceeding 1,500 cc but not exceeding 3,000 cc | ||

| 8703.23.20 | Ambulances and prison vans more than three years old | L | |

| 8703.23.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity not exceeding 2,000 cc, not more than three years old | |||

| 8703.23.61 | Hybrid electric vehicles of a cylinder capacity not exceeding 1600 cc | L | |

| 8703.23.62 | Other, of a cylinder capacity not exceeding 1,600 cc | L | |

| 8703.23.69 | Other | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity exceeding 2,000 cc, more than three years old : | |||

| 8703.23.81 | Hybrid electric vehicles | L | |

| 8703.23.89 | Other | L | |

| Other | |||

| 8703.23.93 | Hybrid electric vehicles of a cylinder capacity not exceeding 2,000 cc, more than three years old | L | |

| 8703.23.94 | Other, of a cylinder capacity not exceeding 2,000 cc, more than three years old | L | |

| 8703.23.97 | Hybrid electric vehicles of a cylinder capacity exceeding 2,000 cc, more than three years old | L | |

| 8703.23.98 | Other, of a cylinder capacity exceeding 2,000 cc, more than three years old | L | |

| 8703.24 | Of a cylinder capacity exceeding 3,000 cc | ||

| 8703.24.20 | Ambulances and prison vans more than three years old | L | |

| 8703.24.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.24.61 | Hybrid electric vehicles

|

L | |

| 8703.24.69 | Other | L | |

| Other, not more than three years old | |||

| 8703.24.81 | Hybrid electric vehicles | L | |

| 8703.24.89 | Other | L | |

| Other vehicles, with compression-ignition internal combustion piston engine (diesel or semi-diesel) | |||

| 8703.31 | Of a cylinder capacity not exceeding 1,500 cc | ||

| 8703.31.20 | Ambulances and prison vans more than three years old | L | |

| 8703.31.40 | Hearses more than three years old | L | |

| 8703.31.60 | Auto-trishaws more than two years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.31.81 | Hybrid electric vehicles | L | |

| 8703.31.89 | Other | L | |

| Other | |||

| 8703.31.93 | Hybrid electric vehicles more than three years old | L | |

| 8703.31.94 | Other, more than three years old | L | |

| 8703.32 | Of a cylinder capacity exceeding 1,500 cc but not exceeding 2,500 cc | ||

| 8703.32.20 | Ambulances and prison vans more than three years old | L | |

| 8703.32.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity not exceeding 2,000 cc, not more than three years old | |||

| 8703.32.69 | Other | L | |

| Motor cars including station wagons and racing cars of a cylinder capacity exceeding 2,000 cc, more than three years old : | |||

| 8703.32.81 | Hybrid electric vehicles | L | |

| 8703.32.89 | Other | L | |

| 8703.32.96 | Hybrid electric vehicles of a cylinder capacity not exceeding 2,000cc, more than three years old | L | |

| 8703.32.97 | Other, of a cylinder capacity not exceeding 2,000cc., more than three years old | L | |

| 8703.32.98 | Hybrid electric vehicles of a cylinder capacity exceeding 2,000cc., more than three years old | L | |

| 8703.32.99 | Other, of a cylinder capacity exceeding 2,000cc., more than three years old | ||

| 8703.33 | Of a cylinder capacity exceeding 2,500 cc | ||

| 8703.33.20 | Ambulances and prison vans more than three years old | L | |

| 8703.33.40 | Hearses more than three years old | L | |

| Motor cars including station wagons and racing cars, more than three years old : | |||

| 8703.33.61 | Hybrid electric vehicles | L | |

| 8703.33.69 | Other | L | |

| Other, more than three years old : | |||

| 8703.33.81 | Hybrid electric vehicles | L | |

| 8703.33.89 | Other | L | |

| 8703.90 | Other |

210 - Motor Boats, Engines, Aero planes, Helicopters and Aircraft spare parts

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization - Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual - National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Recommendation of the Ministry of Defense (for Aero planes, Helicopters)

- Recommendation of the Civil Aviation Authority (for Aero planes, Helicopters and Spare parts of Aero planes and Helicopters)

Procedure

- Submit the above documents required to obtain the license to the Counter of the relevant Unit

- Make payments to the Shroff using the Paying-in-Voucher issued by the Counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the Counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- 0.5 % of CIF Value + Value Added Tax

Customs Classification Codes

| Column 1 HS Heading | Column 11 HS Code | Column 111 Description | Subjected to License Control |

| 88.01 | 8801.00 | Balloons and dirigibles; gliders, hang gliders and other non-powered aircraft. | L |

| 88.02 | Other aircraft (for example, helicopters, aeroplanes); spacecraft (including satellites) and suborbital and spacecraft launch vehicles. | ||

| Helicopters : | |||

| 8802.11 | Of an unladen weight not exceeding 2,000 kg | L | |

| 8802.12 | Of an unladen weight exceeding 2,000 kg | L | |

| 8802.20 | Aeroplanes and other aircraft, of an unladen weight not exceeding 2,000 kg | L | |

| 8802.30 | Aeroplanes and other aircraft, of an unladen weight exceeding 2,000 kg but not exceeding 15,000 kg | L | |

| 8802.40 | Aeroplanes and other aircraft, of an unladen weight exceeding 15,000 kg | L | |

| 8802.60 | Spacecraft (including satellites) and suborbital and spacecraft launch vehicles | L | |

| 88.03 | Parts of goods of heading 88.01 or 88.02. | ||

| 8803.10 | Propellers and rotors and parts thereof | L | |

| 8803.20 |

220 - Motor Engines

Required documentation and requirements

- Letter of Request for Import License

- Application IECD- 02 issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization - Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual - National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

Procedure

- Submit the above documents required to obtain the license to the Counter of the relevant Unit

- Make payments to the Shroff using the Paying-in-Voucher issued by the Counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the Counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- 25 % of CIF Value + Value Added Tax

Customs Classification Codes

230 - Vehicle Body Shells (body and chassis separable and inseparable)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization - Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual - National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Registration as a local industry for assembling vehicles in Sri Lanka

- Letter of Approval of the Ministry of Industries

- Recommendation of the Department of Motor Traffic

Procedure

- Submit the above documents required to obtain the license to the counter of the relevant Unit

- Make payments to the Shroff using the Paying-in-Voucher issued by the counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- Rs. 50,000 per unit of separable body and chassis + Value Added Tax

- Rs. 150,000 per unit of inseparable body and chassis + Value Added Tax

Customs Classification Codes

240 - Motorcycles (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization, Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual, National Identity Card or Passport and its photocopy

- Pro forma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

Procedure

- Submit the above documents required to obtain the license to the counter of the relevant Unit

- After the approval is given make payments to the Shroff using the Paying-in-Voucher issued by the counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

245 - Safety Helmets

License Fees

- Engine Capacity between 0-350 CC - Rs. 5, 000 per unit

- Engine Capacity between 351-800 CC - Rs. 10,000 per unit

- Engine Capacity between 801-1000 CC - Rs. 20,000 per unit

- Engine Capacity over 1000 CC - Rs. 30,000 per unit

Customs Classification Codes

250 - Other Vehicles (Cars, Vans, Cabs) (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization, Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual, National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

Photographs showing front and back side of the vehicle - Bank Accounts Statements (Bank Accounts Statements in respect of last 3 months preceding to the month of the application submitted)

Procedure

- Submit the above documents required to obtain the license to the counter of the relevant Unit

- After the approval is given make payments to the Shroff using the Paying-in-Voucher issued by the counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- 25% of CIF Value + Value Added Tax : up to 5 years exceeding the period subjected to license control

- 30% of CIF Value + Value Added Tax : over 5 years exceeding the period subjected to license control

Customs Classification Codes

260 - Vehicles imported by Resident Foreign Nationals (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization, Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual, National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

Photographs showing front and back side of the vehicle - Bank Accounts Statements to confirm remittance of a sum exceeding US$ 50,000 to Sri Lanka during the last 3 years

- Certificates to confirm the relationship between the donor and the recipient

- Copies of the Passport and Visa (Dual citizenship, Resident Visa or Work Visa)

Procedure

- Submit the above documents required to obtain the license to the counter of the relevant Unit

- After the approval is given make payments to the Shroff using the Paying-in-Voucher issued by the counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- 0.3 % of CIF Value + Value Added Tax

270 - Heavy Vehicles (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization, Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual, National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Cancellation of Registration (De-Registration) of the relevant vehicle and its English translation

Photographs showing front and back side of the vehicle - Bank Accounts Statements

Procedure

- Submit the above documents required to obtain the license to the counter of the relevant Unit

- After the approval is given make payments to the Shroff using the Paying-in-Voucher issued by the counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- Rs. 75,000 per unit + Value Added Tax, in the case of a vehicle between 3-5 years old

- Rs. 150,000 per unit + Value Added Tax, in the case of a vehicle between 7-10 years old

- Rs. 200,000 per unit + Value Added Tax, in the case of a vehicle between 10-12 years old

- Rs. 250,000 per unit + Value Added Tax, in the case of a vehicle between 12-15 years old

- Rs. 300,000 per unit + Value Added Tax, in the case of a vehicle between 15-20 years old

275 - Vehicles imported for Re-export after Repairs (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization, Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual, National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Certificate of Registration of Business

- Letter to confirm registration under the scheme of Temporary Import for Export Processing (TEIP)

- Bank Accounts Statements

Procedure

- Submit the above documents required to obtain the license to the counter of the relevant Unit

- After the approval is given make payments to the Shroff using the Paying-in-Voucher issued by the counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- Rs. 10,000 per Car unit + Value Added Tax

- Rs. 5,000 per Motorcycle unit + Value Added Tax

280 - Cut portions of Motor Vehicles (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization, Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual, National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Letter issued by the Customs, if purchased from the Customs Auction

- Bank Accounts Statements

Procedure

- Submit the above documents required to obtain the license to the counter of the relevant Unit

- After the approval is given make payments to the Shroff using the Paying-in-Voucher issued by the counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- 25% of value + Value Added Tax

285 - Used Tyres (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization, Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual, National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Bank Accounts Statements

Procedure

- Submit the above documents required to obtain the license to the counter of the relevant Unit

- After the approval is given make payments to the Shroff using the Paying-in-Voucher issued by the counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- 50% of CIF Value + Value Added Tax

290 - Chassis, Chassis purchased from Customs Auction, Motorcycle Frames (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization, Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual, National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Letter issued by the Customs, if pruchased from the Customs Auction

- Bank Accounts Statements

Procedure

- Submit the above documents required to obtain the license to the counter of the relevant Unit

- After the approval is given make payments to the Shroff using the Paying-in-Voucher issued by the counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- Chassis - Rs. 30,000 per unit + Value Added Tax

- Motorcycle Frames - Rs. 5 ,000 per unit + Value Added Tax

305 - Electric Auto Trishaws (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization, Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual, National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

Procedure

- Submit the above documents required to obtain the license to the counter of the relevant Unit

- After the approval is given make payments to the Shroff using the Paying-in-Voucher issued by the counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

320 – Used Vehicle Seats (This scheme is not currently operational.)

Required documentation and requirements

- Letter of Request for Import License

- Application issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

- Where the importer is an organization, Original and a photocopy of the Business Registration Certificate

- Where the importer is an individual, National Identity Card or Passport and its photocopy

- Proforma Invoice issued by the Exporter or Supplier

- Letter issued by the Customs, if pruchased from the Customs Auction

- Bank Accounts Statements

Procedure

- Submit the above documents required to obtain the license to the counter of the relevant Unit

- Secure approval of the Minister in charge of the subject for the above documents required for obtaining the license

- Make payments to the Shroff using the Paying-in-Voucher issued by the counter for the application approved by the Controller General

- Submit the receipt issued for the payment to the counter

- After printing and signing the license, obtain the license from the Counter and its photocopies affixed with the seal confirming the issuance of the license

License Fees

- Used vehicle seats (8 units) – 50% of CIF Value + Value Added Tax

Industrial Chemicals (500)

1. Required documentation

1. Application IECD- 01 (Indent) issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

2. i. Where the importer is an organization,

- Original and a photocopy of the Business Registration Certificate (It suffices to submit these documents only at the first instance.)

ii. Where the importer is an individual,

- National Identity Card and its photocopy

3. Proforma Invoice issued by the Supplier and it should include the following details:

- Names and addresses of the Supplier and Importer

- Details of the good or commodity, quantity and value

- Country of origin

- Country of shipment

- Number and date of the proforma invoice

4. Letter of Recommendation or Licenses issued to the Controller General of Import and Export by the Organization with relevant authorization to make recommendation for issuance of a license.

2. Procedure

- Submit the above documents required to obtain the license to the counter of the relevant Unit

- Make payments to the Shroff using the Paying-in-Voucher issued by the counter for approved documents

- Submit the receipt issued for the payment to the counter

- After printing and signing the license, obtain the license from the Counter and photocopies affixed with the seal confirming the issuance of the license

3. License Fees

- 0.3% of CIF Value + Value Added Tax

1. Required Documentation

- Debit Declaration

- Customs Declaration

- Bank endorsed Commercial Invoice

- Import License

- Bill of Lading or Air Way Bill

- Delivery Order (Where Bill of Lading is only a copy)

2. Debiting Fees

Fee is not charged for debiting of license. However, additional fees should be paid in the event of breach of import and export regulations or terms and conditions.

3. Procedure

- Copies and photocopies of required documents should be submitted to the Counter in duplicate.

- Additional fees should be paid, where required to the Shroff using the Paying-in-Voucher provided by the Counter, subsequent to the debiting process by the Officer concerned and the printed Debit Note and the originals should be obtained from the Counter.

Petroliam Oils, Lubricants and Allied Products (510)

1. Required documentation

1. Application IECD- 01 (Indent) issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

2. i. Where the importer is an organization,

- Original and a photocopy of the Business Registration Certificate (It suffices to submit these documents only at the first instance.)

ii. Where the importer is an individual,

- National Identity Card and its photocopy

3. Proforma Invoice issued by the Supplier and it should include the following details: